Offline payment privacy white paper released by Lipis Advisors in partnership with Crunchfish

Lipis Advisors in partnership with Crunchfish released today the third white paper in the series “Enabling offline payments in an online world” with the title “Privacy considerations”. A webinar covering the key insights of the whitepaper will be held tomorrow morning streamed live at 8 am CET / 11.30 IST.

Increased digitalization, cash displacement, and the introduction of CBDCs raise many thought-provoking questions for society. What role should payment market infrastructures play in safeguarding privacy? Is privacy a human right or a luxury good? Above all, it is important for payment system operators not to simply take the current privacy framework as a given and to evaluate how they can play a role as thought leaders in this area. Enhancing the privacy features of existing payment methods is important as many studies have shown that privacy concerns can have a significant impact on users’ willingness to use or adopt digital payment methods or services.

This whitepaper will be followed up with a webinar streamed live on May 12th at 8 am CET / 11.30 IST. Watch the video trailer for this webinar and register following this link. The webinar will be live streamed on Zoom and LinkedIn, it will also be recorded. All webinars in the series are available here.

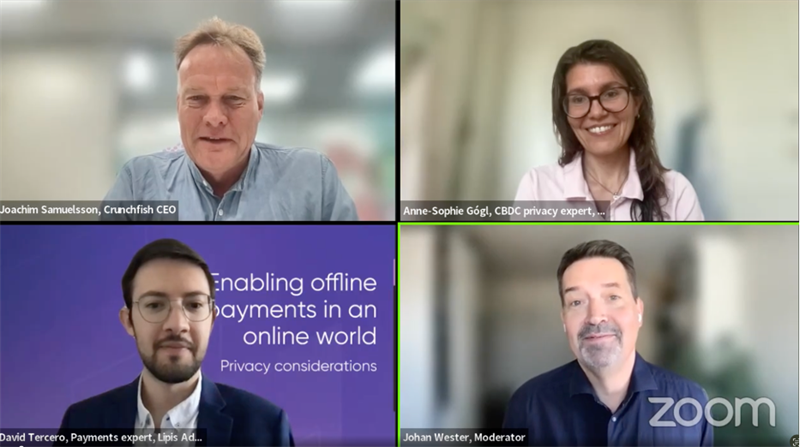

The webinar will start with a short presentation of the white paper, followed by moderated Q&A with a panel and the audience. In the panel for the third webinar is Payment expert David Tercero at Lipis Advisors, Anne-Sophie Gógl, CBDC privacy expert, Digital Euro Association and Crunchfish CEO Joachim Samuelsson. The webinar is moderated by Johan Wester.

The previous two white papers in the series Enabling offline payments in an online world focused on offline payment design and security.

For more information, please contact:

Joachim Samuelsson, CEO of Crunchfish AB

+46 708 46 47 88

joachim.samuelsson@crunchfish.com

The information was provided by the contact person above for publication on 11 May 2023 at 14:30 CET. Västra Hamnen Corporate Finance AB is the Certified Adviser. Email: ca@vhcorp.se. Telephone +46 40 200 250.

About Lipis Advisors – lipisadvisors.com

Lipis Advisors is a Berlin-based strategic consulting firm focused exclusively on the payments sector. Our expertise has expanded over the years, evolving from research-driven comparative analysis of core payment systems to strategic advice for diverse stakeholders on topics ranging from cryptocurrencies, CBDCs, digital banking, real-time payments, fraud mitigation, payment design and implementation. We have provided consulting services to clients in 40+ countries around the world, including international organizations, financial institutions, payment service providers, fintechs, payment schemes, payment system operators, technology vendors, industry associations, and regulators.

About Crunchfish – crunchfish.com

Crunchfish is a deep tech company developing a Digital Cash platform for Banks, Payment Services and CBDC implementations and Gesture Interaction technology for AR/VR and automotive industry. Crunchfish is listed on Nasdaq First North Growth Market since 2016, with headquarters in Malmö, Sweden and with a subsidiary in India.

Download as PDF