Crunchfish announces Digital Cash Wallets’ architecture

Crunchfish Digital Cash AB (“Crunchfish”) is announcing a patent-pending architecture of Digital Cash Wallets. In addition to Crunchfish’s original Digital Cash Wallet offline, that is integrated in a mobile app, an architecture spanning from Core Banking Systems to Digital Cash Wallets either online or offline, in mobile apps or on non-mobile devices is presented. This provides the foundation of Crunchfish’s ambition to take a global leadership position within digital payments. The Digital Cash Wallets online and in mobile apps are already ready for shipment.

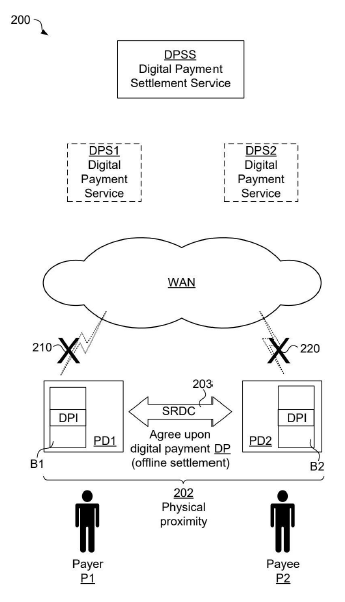

Immensely popular payment services such as Swish in Sweden and UPI in India are both very vulnerable as all backend payment servers as well as the payer’s internet connection must be up and running. This Digital Cash Wallet online relaxes these conditions by providing payment availability despite service disruption or server congestion, as well as load balancing of the Core Banking System. Other features such as interoperability, privacy, inclusiveness, and flexibility in respect to form factor, mobile-OS and proximity interaction are offered as well by Digital Cash Wallets to payment services.

The recently announced Digital Cash Wallet online has been very well received in the market, especially by banks and instant payment services experiencing the above challenges. We are happy to announce that it is already ready for shipment as an integrated wallet that architecturally fits between the Core Banking System and the patented Digital Cash Wallets in mobile apps.

”This architecture of Digital Cash Wallets provides the very foundation of Crunchfish’s ambition to take a global leadership position within digital payments”,says Joachim Samuelsson, CEO of Crunchfish.

We are also announcing an additional layer of wearables and smart cards to the architecture of Digital Cash Wallets. Top-up and payment in stores using these Digital Cash Wallets are done by tapping a mobile device to interact with a Digital Cash Wallet in a mobile app. A patent-pending application allows this interaction to occur completely offline. The development of Digital Cash Wallets in non-mobile devices will commence in 2022.

Crunchfish Digital Cash Wallets are all integrated in a modular architecture. An account reservation in the Core Banking System provides a balance in the Digital Cash Wallet online, which in turn may be distributed to one or many Digital Cash Wallets in mobile apps. This balance may be further distributed to one or many Digital Cash Wallets in non-mobile device. This provides the global payments market with a complete architecture that works online as well as offline, on all kinds of bearer devices, and on all kinds of payment schemes such as Instant, CBDC, Card as well as Crypto.

For more information, please contact:

Joachim Samuelsson, CEO of Crunchfish AB

+46 708 46 47 88

joachim.samuelsson@crunchfish.com

Erik Berggren, IR Manager

+46 726 01 16 73

This information is information that Crunchfish AB is obliged to publish in accordance with the EU Market Abuse Regulation. The information was provided by the contact person above for publication on 20 December 2021 at 00:01 CET.

Västra Hamnen Corporate Finance AB is the Certified Adviser. Email: ca@vhcorp.se. Telephone +46 40 200 250.