Crunchfish join pivotal mobile telecom partnership for Africa

Crunchfish join a new pivotal partnership with the objective to enable mobile operations and services in Africa with financing, telecom network infrastructure and disruptive technologies using an Anything-as-a-service mindset. Crunchfish AB have today signed a Memorandum of Understanding with Socio ApS, the Danish management and investment company behind the partnership, for potential financing of Crunchfish.

The objective of this partnership is to enable the digital infrastructure across Africa to fill critical gaps by enabling mobile services with telecom infrastructure and disruptive technologies, to provide significantly better cost structures, use cases and quality. The mindset is Anything-as-a-service to make it possible for companies and entrepreneurs to enter the mobile telecom industry with very little CAPEX.

The partnership includes mobile telco group Eferio Communications A/S, Telecom network provider Radiocloud AB, mobile antenna pioneer Radio Innovation AB and offline payments pioneer Crunchfish AB. The management and investment company behind this partnership is Socio ApS, which in turn partner with Revenue Share Capital, with the aim to provide financing, subject to due diligence, by equity investments and non-dilutive revenue sharing models, to enable mobile operations and services in Africa and other emerging markets.

Crunchfish have today signed a Memorandum of Understanding with Socio for a potential financing of Crunchfish. Socio intend, subject to due diligence, to make an initial direct equity investment into Crunchfish for three million shares on market-based terms and conditions. After the initial investment, additional financing can be made available in the form of further equity investments or based on non-dilutive revenue-sharing models. Socio have the financial instruments ready to bring this investment in place within three months from today.

Despite huge infrastructure developments, more than 70% of Africa’s 1.2 billion citizens are still not connected to the Internet, and a large portion of already connected are struggling with bad or slow online connections. Many barriers keep people and businesses from using mobile services and stops digital transformations to be implemented. This challenging situation is similar in many emerging markets in Africa, Asia and Latin America. In India, for instance, more than 50% of the 1.4 billion population lack internet connectivity.

”New entrants into high-growth telco markets traditionally need extensive infrastructure, technology, and financial resources. We enable mobile operations with disruptive technology and financing solutions. A game changer that creates inclusion into the digital society for millions of people and companies. We are extremely pleased to have Crunchfish to join as a partner as mobile payments services can be rolled out much faster with offline payments.”, says Jørgen Gransøe, CEO of Socio ApS.

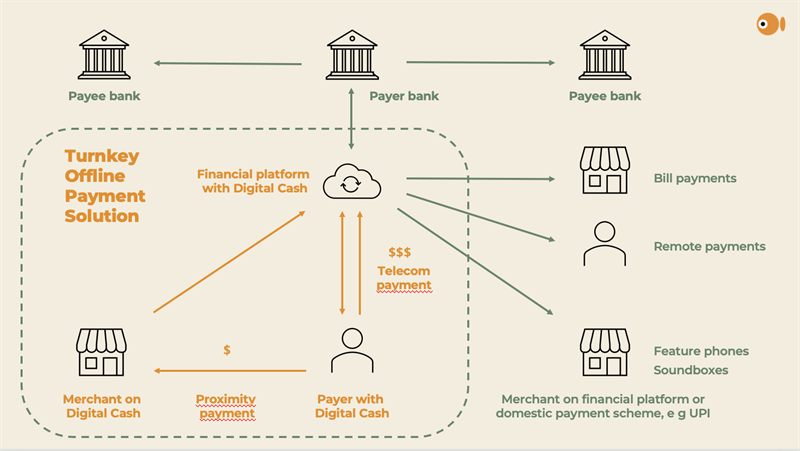

“This partnership is extremely important for Crunchfish for several reasons. It is an excellent entry ticket to Africa, where our offline payment solution can be made available to countries and communities where it is needed the most. We will also get a chance to develop Digital Cash for mobile telecom operators, which play a key role in delivering payment services for many emerging markets. Furthermore, Crunchfish may get access to financing as we accelerate our roll-out”, says Joachim Samuelsson, CEO of Crunchfish.

About Socio ApS, CEO Jørgen Gransøe

Socio is a business enabler and investment company focusing on telecommunications and fintech by building infrastructure and operations on the African continent and on other emerging markets. Socio invests in technologies and concepts that enhance the entire value-chain, from the mobile network to the consumer.

About Eferio Communications A/S, CEO Richard Murbeck

Eferios objective is to become a major player in the digital infrastructure sector across Africa. Our strategy is to build a group of network operators through roll-up mergers and a comprehensive application of revenue-based financing. We will then over time turn these assets into Multibrand-Operators where we use Connectivity-as-a-service, Spectrum-as-a-service and have the best Multibrand platform at hand. It’s our belief that our business and technology operations are most successfully served by sourcing from leading global technology partners with deployment of country-specific knowledge and experience via local high-skilled personnel. Eferio Communications has its HQ in Kenya with a geographical separated entity Socio ApS for legal and financial operations with HQ in Denmark.

About Radiocloud AB, CEO Anil Raj

Radiocloud AB is a digital infrastructure company focused on building and operating shared passive and active networking infrastructure in developing economies. Sharing infrastructure reduces financial risks and increases viability and profitability for network operators allowing them to focus on developing and providing new services to their customers. Radiocloud works in close cooperation with mobile network operators, regulators, financial institutions and technology providers to direct capital, resources, and technology to developing markets helping reduce barriers to entry and bridging access to the internet to underserved markets and communities. With its headquarters in Sweden, Radiocloud is led by a highly experienced management team tracing its roots back to the earliest days of the mobile industry.

About Radio Innovation AB, CEO Dusyant Patel

Radio Innovation is a unique and innovative communications infrastructure company, developing disruptive antenna solutions that help CSP’s (Communications service providers) or PN’s (Private Networks) cut CAPEX and OPEX up to 85%, making it profitable to cover even the most rural areas, with reliable and affordable mobile connectivity. The technology works by reducing the number of tower sites while using extremely efficient antenna technology. With less sites Radio Innovation dramatically reduces the environmental footprint while also enabling city areas to go higher in their capacity needs without the need to build new infrastructure, but by just replacing the antennas on the existing tower sites. Radio Innovations mission is to give every individual an equal opportunity to be digitally included no matter where in the world they are.

For more information, please contact:

Joachim Samuelsson, CEO of Crunchfish AB

+46 708 46 47 88

joachim.samuelsson@crunchfish.com

This information is Crunchfish AB obliged to publish in accordance with the EU Market Abuse Regulation. The information was provided by the contact person above for publication on 23 November 2022 at 16:00 CET.

Västra Hamnen Corporate Finance AB is the Certified Adviser. Email: ca@vhcorp.se. Telephone +46 40 200 250.

About Crunchfish – crunchfish.com

Crunchfish is a deep tech company developing a Digital Cash platform for Banks, Payment Services and CBDC implementations and Gesture Interaction technology for AR/VR and automotive industry. Crunchfish is listed on Nasdaq First North Growth Market since 2016, with headquarters in Malmö, Sweden and with a subsidiary in India.

Download as PDF