Crunchfish and HDFC Bank in project with Reserve Bank of India

Crunchfish in partnership with HDFC Bank have made a joint application to access Reserve Bank of India (RBI) Regulatory Sandbox to demonstrate and pilot offline retail payments. The application has been approved and the integration has begun. The project, if successful, will provide the basis for RBI’s guidance and regulatory support in providing offline retail payments based on Crunchfish Digital Cash platform to the payment ecosystem of India.

“HDFC Bank is excited to partner with Crunchfish Digital Cash for offline retail payments. This innovative solution will enable HDFC Bank to reach a wider audience and allow its customers and merchants to make and receive payments in complete offline mode. This will boost financial inclusion by increased adoption of digital payments as it enables transactions without the need of network connections.”, says Anjani Rathor, Chief Digital Officer at HDFC Bank.

HDFC Bank is India’s leading private bank and was among the first to receive approval from RBI to set up a private sector bank in 1994. Today, HDFC Bank has a banking network of 6,342 branches in 3,188 cities. HDFC Bank offers a diverse range of financial products and banking services to customers through a growing branch network and digital channels such as Netbanking and MobileBanking.

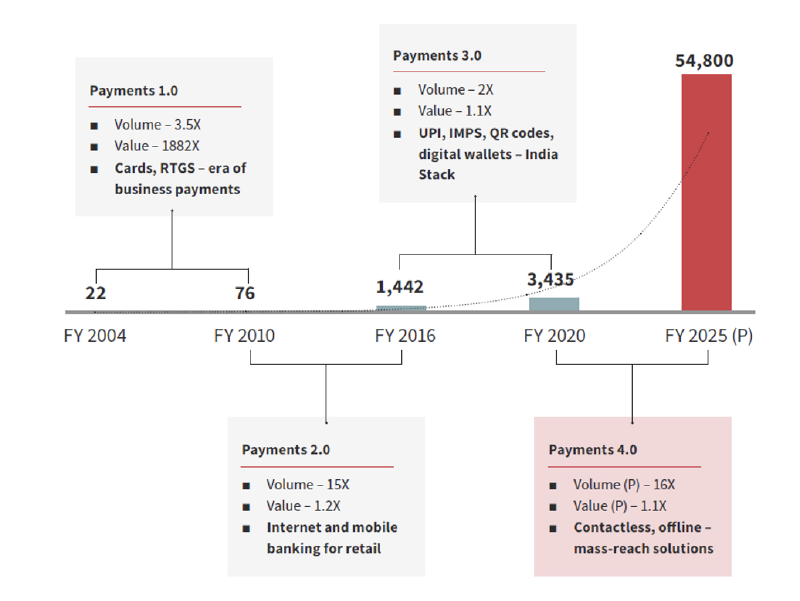

“India is the leading real-time payments market in the world and in focus for our sales and marketing efforts. Crunchfish Digital Cash is highly relevant for the Indian market as it drives financial inclusion and increased payment availability. It is a great milestone for Crunchfish to team up with HDFC Bank to showcase Digital Cash for RBI.”, says Joachim Samuelsson, Crunchfish’s CEO.

The Regulatory Sandbox was established in 2020 by the Reserve Bank of India (RBI) to foster responsible innovation in financial services, promote efficiency and bring benefit to end users. The Regulatory Sandbox is a formal regulatory program for market participants to test new products and services with customers in a live environment, subject to certain safeguards and oversight. It allows the regulator, innovators, financial service providers and end users to conduct field tests to collect evidence on the benefits of new financial innovations, while carefully monitoring and containing their risks. To be approved access to the Regulatory Sandbox, the proposed financial service shall include new or emerging technology, or use of existing technology in an innovative way and should address a problem and bring benefits to consumers.

For more information, please contact:

Joachim Samuelsson, CEO of Crunchfish AB

+46 708 46 47 88

joachim.samuelsson@crunchfish.com

This information is Crunchfish AB obliged to publish in accordance with the EU Market Abuse Regulation. The information was provided by the contact person above for publication on 5 September 2022 at 14:45 CET.

Västra Hamnen Corporate Finance AB is the Certified Adviser. Email: ca@vhcorp.se. Telephone +46 40 200 250.

About Crunchfish – crunchfish.com

Crunchfish is a deep tech company developing a Digital Cash platform for Banks, Payment Services and CBDC implementations and Gesture Interaction technology for AR/VR, automotive and digital interfaces. Crunchfish is listed on Nasdaq First North Growth Market since 2016, with headquarters in Malmö, Sweden and with a subsidiary in India.

Appendix