Crunchfish awarded for Outstanding Advancement in Digital Currency

Crunchfish was awarded at the Digital Currency Conference in Mexico City for Outstanding Advancement in Digital Currency. The award recognizes a company that has made a huge impression in the space and transformed the way digital currency is experienced. The jury was impressed by Crunchfish Digital Cash as a software-based, tamper-resistant solution.

Crunchfish won the category Outstanding Advancement in Digital Currency at the Digital Currency Awards on May 18th at the Digital Currency Conference in Mexico City for its software-based Digital Cash solution. The award recognizes a company that has made a huge impression in the space with new and innovative services and transformed the way digital currency is experienced.

“We are extremely proud of this award for Crunchfish Digital Cash. Crunchfish is pioneering software-based offline payments for CBDC and payments applications. Swedish soccer star Zlatan Ibrahimovic once said of another player “What Carew does with a football, I can do with an orange”. The picture travesty points out the key differentiator “What the competition does in hardware, Crunchfish can do in software”, says Joachim Samuelsson, CEO at Crunchfish.

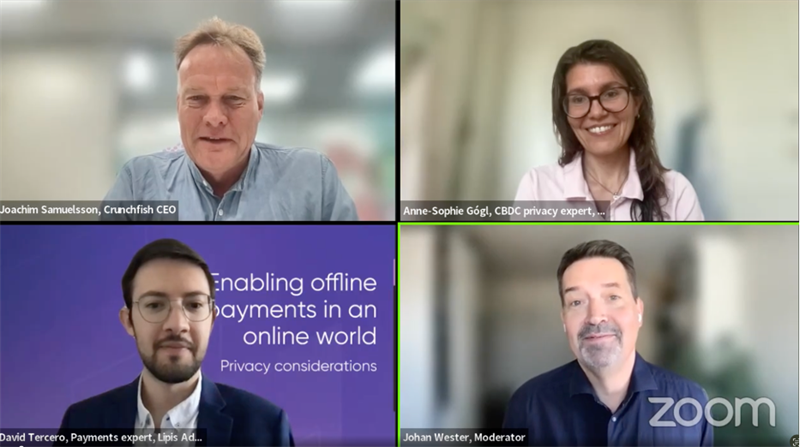

Crunchfish is represented at the conference by CEO Joachim Samuelsson, who participates in a panel on offline payments and presents on the theme Central Banks should modernize payments. Who else would?

For more information, please contact:

Joachim Samuelsson, CEO of Crunchfish AB

+46 708 46 47 88

joachim.samuelsson@crunchfish.com

The information was provided by the contact person above for publication on 19 May 2023 at 08:30 CET. Västra Hamnen Corporate Finance AB is the Certified Adviser. Email: ca@vhcorp.se. Telephone +46 40 200 250.

About Crunchfish – crunchfish.com

Crunchfish is a deep tech company developing a Digital Cash platform for Banks, Payment Services and CBDC implementations and Gesture Interaction technology for AR/VR, e-commerce, and the automotive industry. Crunchfish is listed on Nasdaq First North Growth Market since 2016, with headquarters in Malmö, Sweden and a subsidiary in India.